April

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. |_|)☐)

Filed by the Registrant |X|☒

Filed by a Party other than the Registrant |_|☐

Check the Appropriate Box:

|_|☐ Preliminary Proxy Statement

|_| ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))|X|☒ Definitive Proxy Statement|_|☐ Definitive Additional Materials|_|☐ Soliciting Material Under Rule 14a-12

ENB Financial Corp

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

|X|

☒ No fee required|_| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

|_|☐ Fee paid previously with preliminary materials:materials.

|_| Check box if any part of the fee is offset as provided

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rule 0-11(a)(2)Rules 14a6(i)(1) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

0-11

ENB FINANCIAL CORP

31 East Main Street

Ephrata, PA 17522

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON TUESDAY, MAY 10, 2016

7, 2024

TO THE SHAREHOLDERS OF ENB FINANCIAL CORP:

NOTICE IS HEREBY GIVEN that the Annual Meeting of the Shareholders of ENB Financial Corp (the “Corporation”) will be held at the Main Office of Ephrata National Bank, 31124 East Main Street, 5th Floor of Brossman

Building Complex, Ephrata, Pennsylvania 17522 on Tuesday, May 10, 2016,7, 2024, at 1:00 p.m., local time,Eastern Time, for the purpose of considering and voting upon the following matters:

| 1. | To elect |

| 2. | To |

| 3. |

| To transact such other business as may properly be presented at the annual meeting and any adjournment or postponement of the meeting. |

Shareholders of record at the close of business on Friday,Monday, March 11, 2016,2024, are entitled to notice of and to vote at the Annual Meeting of Shareholders.

Your vote is important regardless of the number of shares you own. Please submit your vote by completing and signing the enclosed proxy card and mailing it promptly in the postage paid envelope or, if you prefer, you may vote by telephone at 1-800-652-8683 or via the Internet at www.investorvote.com/ENBP. Internet voting is available until 1:00 a.m. Eastern Time the day of the meeting. We cordially invite you to attend the meeting. Your proxy is revocable and you may withdraw it at any time prior to voting at the meeting. You may deliver notice of revocation or deliver a later dated proxy to the Secretary of the Corporation before the vote at the meeting. If you are a shareholder whose shares are registered in “street name” and held in a stock brokerage account or by a bank or other nominee, you will need additional documentation from your broker in order to vote in person at the meeting.

We enclose, among other things, a copy of the 20152023 ENB Financial Corp Annual Report.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on Tuesday, May 10, 2016:7, 2024: The proxy statement,Proxy Statement, proxy card and 20152023 Annual Report are available on the Internet at: www.investorvote.com/ENBP.

| By Order of the Board of Directors, | |

| |

| |

| Chairman, President | |

| Ephrata, Pennsylvania | |

April |

PROXY STATEMENT

Dated and mailed on or about April 8, 20169, 2024

ENB FINANCIAL CORP

31 EAST MAIN STREET

EPHRATA, PENNSYLVANIA 17522

(717) 733-4181

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON TUESDAY, MAY 10, 20167, 2024

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

OF

ENB FINANCIAL CORP

MAY 10, 20167, 2024

ENB Financial Corp was formed on July 1, 2008 asis the holding company for Ephrata National Bank. Throughout this proxy statement, ENB Financial Corp and its wholly owned subsidiary, Ephrata National Bank, will be collectively referred to as “the Corporation” and, on behalf of the Board of Directors (“the Board”), furnishes this proxy statement in connection with the solicitation of proxies for use at the Corporation’s 20162024 Annual Meeting of Shareholders. This proxy statement and the related proxy card are being distributed on or about April 8, 2016.9, 2024.

We have not authorized anyone to provide you with information about the Corporation; therefore, you should rely only on the information contained in this document or in the documents to which we refer you. Although we believe we have provided you with all the information helpful to you in your decision to vote, events may occur at the Corporation subsequent to printing this proxy statement that might affect your decision or the value of your stock.

Date, Time and Place offor the Annual Meeting

The Annual Meeting of Shareholders will be held on Tuesday, May 10, 2016,7, 2024, at 1:00 p.m., local time,Eastern Time, at the Main Office of Ephrata National Bank, 31124 East Main Street, 5th Floor of Brossman Building Complex, Ephrata, Pennsylvania 17522.17522. All inquiries regarding the annual meeting should be sent by mailmailed to Barry W. Harting,Adrienne L. Miller, Esq., Corporate Secretary, 31 East Main Street, P.O. Box 457, Ephrata, Pennsylvania 17522 or by telephone at (717) 733-4181.

At the annual meeting, shareholders will vote on the following matters:

| 1. | To elect |

| 2. | To |

| 3. |

| To transact such other business as may properly be presented at the annual meeting and any adjournment or postponement of the meeting. |

PROXY SOLICITATION AND VOTING PROCEDURES

The Board solicits this proxy for use at the Corporation’s 20162024 Annual Meeting of Shareholders and the Corporation will pay the cost of preparing, printing, assembling, mailing, and soliciting proxies and any additional material that the Corporation sends to its shareholders. In addition to the solicitation of proxies by mail, the Corporation’s directors, officers, and employees may solicit proxies in person or by telephone, facsimile, email, or other similar electronic means without additional compensation. The Corporation will make arrangements with brokerage firms and other custodians, nominees, and fiduciaries to forward proxy solicitation material to the beneficial owners of stock held by these entities. The Corporation will, upon request, reimburse these third parties for their reasonable expenses in forwarding proxy solicitation material to the beneficial owners of stock.

1

Only shareholders of record at the close of business on March 11, 2016,2024, may vote at the meeting. As of the close of business on March 11, 2016,2024, the record date for the annual meeting, 2,869,5575,739,114 shares of the Corporation’s common stock, par value $0.20$0.10 per share, were issued and 2,849,7585,654,355 shares were outstanding.

If your shares are registered directly in your name with the Corporation’s transfer agent, Computershare, you are considered, with respect to those shares, the shareholder of record, and these proxy materials are being sent directly to you by the Corporation. You can vote your shares by completing and returning a written proxy card or by voting via the Internet or telephone as instructed on the proxy card. You may also vote in person at the meeting. The method by which you vote will in no way limit your right to attendparticipate and vote at the annual meeting if you later decide to attend in person.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker how to vote, and you are also invited to attend the meeting. However, because you are not the shareholder of record, you may not vote your street name shares in person at the meeting unless you obtain a proxy executed in your favor from your broker or nominee, the holder of record. Your broker or nominee has enclosed a voting instruction card for you to use in directing the broker or nominee how to vote your shares.

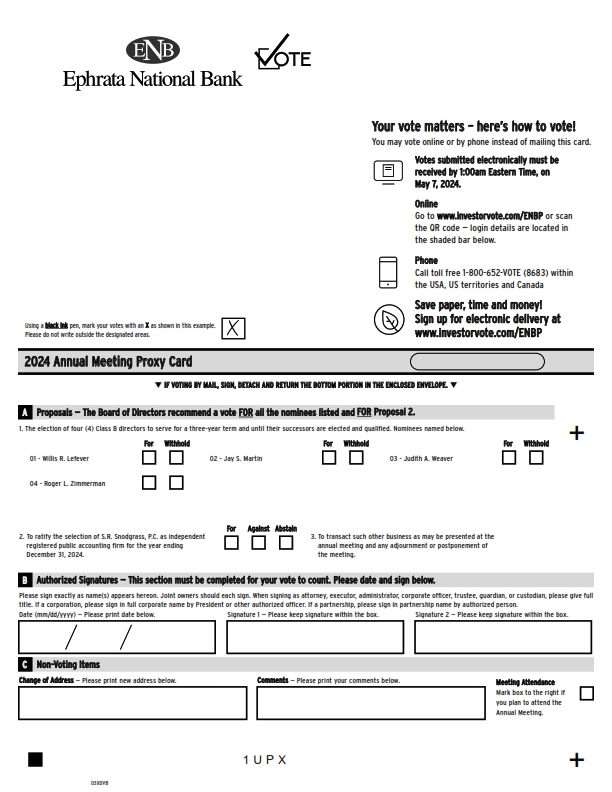

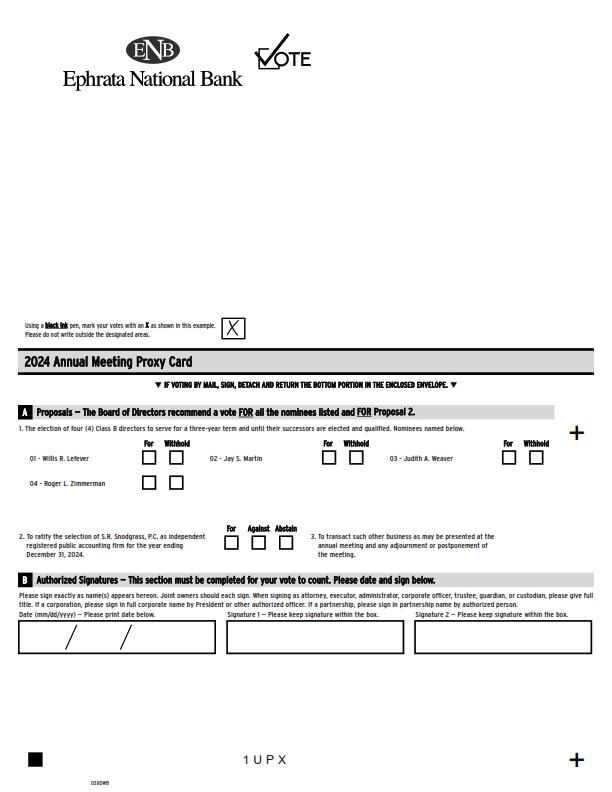

By properly completing a proxy, you appoint Janice S. EabyAaron L. Groff, Jr. and John H. ShueyMary E. Leaman as proxy holders to vote your shares in accordance with your instructions as indicated on the proxy card. Any signed proxy card not specifying to the contrary will be voted:

| · | FOR the election of the director nominees identified in this proxy statement; |

| · | FORthe |

| · | FOR the approval to transact such other business as may properly be presented at the annual meeting and any adjournment or postponement of the meeting. |

As of the date of this document, the Board of Directors knows of no matters that will be presented for consideration at the annual meeting other than the ones described in this document. If any other matters shall properly come before the meeting and be voted upon, the persons named as proxy holders will vote on those matters in accordance with the recommendations of the Board of Directors.

Shareholders of record who completed proxies may revoke them at any time before they are voted at the annual meeting by:

| · | delivering a written notice of revocation to |

| · | voting via telephone or Internet or by delivering a duly executed proxy bearing a later date to the Corporate Secretary; or |

| · | voting in person after giving written notice to the Corporate Secretary. |

2

Quorum and Votes Required for Approval

In order to hold the annual meeting, a quorum of the Corporation’s outstanding shares must be present. Under Pennsylvania law and the Corporation’s bylaws, of ENB Financial Corp, a majority of the outstanding shares of common stock, represented in person or by proxy, constitutes a quorum for the purpose of conducting business. Votes withheld and abstentions will be counted for determining the presence of a quorum but Brokerbroker non-votes will not be counted for determining the presence of a quorum for a particular matter as to which the broker withheld authority.

IfEach share is entitled to one (1) vote on all matters submitted to a quorum is present,vote of shareholders. All matters to be voted on by the shareholders will electrequire an affirmative vote of a majority of shares voted, in person or by proxy, at the nominees for directorannual meeting, except in cases where the vote of a greater number of shares is required by law or under the Corporation’s articles of incorporation or bylaws. In the case of election of directors, the candidates receiving the highest number of ““FOR”FOR” votes cast by those shareholders entitled to vote for the election of directors are elected. Shareholders are not entitled to cumulate votes for the election of directors. The proxy holders will not cast votes for or against any director nominees where the broker withheld authority.

Cumulative voting rights exist only with respect to the election of directors, which means that each shareholder has the right, in person or by proxy, to multiply the number of votes to which he or she is entitled by the number of directors to be elected, and to cast the whole number of such votes for one candidate or to distribute them among two or more candidates. On all other matters to come before the annual meeting, each share of common stock is entitled to one (1) vote.

Assuming the presence of a quorum, the approval and adoption of the amendment to Article 7 of the Articles of Incorporation to eliminate cumulative voting rights requires the affirmative vote of a majority of the votes cast by all shareholders entitled to vote on the matter.

The Corporation’s governing body is its Board of Directors. The Board is responsible for directing and overseeing the management of the Corporation’s business in the best interests of its shareholders and to fulfill its mission of service to the communities in which it conducts business. In carrying out its responsibilities, the Board selects and monitors senior management, provides oversight for financial reporting, legal, and regulatory compliance, determines the Corporation’s governing principles, and implements its governance policies. The Board believes that the purpose of corporate governance is to ensure that ENB Financial Corpthe Corporation is managed for the long-term benefit of its shareholders, and to conduct business in a manner consistent with legal requirements and the highest standards of integrity. The Board has adopted and adheres to corporate governance practices that it believes promote this purpose.

Composition of the Board of Directors

The Board of Directors seeks to ensure that it is composed of members whose particular experience, qualifications, attributes, skills, and diversity, when taken together as a group, will allow the Board of Directors to satisfy its oversight responsibilities effectively. In identifying candidates for Director, the Nominating and Governance Committee and the Board of Directors takes into account: (1) the comments and recommendations of individual Board members regarding the effectiveness of the existing Board of Directors or the need to enhance the Board of Directors with members who bring particular experience, qualifications, attributes, skills, and diversity; (2) the necessary expertise and sufficiently diverse business and social backgrounds of the overall composition of the Board of Directors to effectively represent the market areas in which ENB Financial Corpthe Corporation conducts business; (3) the independence of non-employee Directors and other possible conflicts of interest of existing and potential members of the Board of Directors; and (4) other criteria that assures representation of the general population of the communities in which the Corporation is involved.

Leadership Structure of the Board of Directors

The Board of Directors is structured in a way that provides for leadership from the Chairman. TheJeffrey S. Stauffer serves as the Chairman of the Board of Directors and also serves as President and Chief Executive Officer of the Corporation. The

3

Board of Directors has not established a position of “Lead Director” from among the independent directors, nor does any independent director assume that position of leadership within the Board. The Board of Directors believes this leadership structure is appropriate for the Corporation considering the structure of the Corporation, the number of Board meetings, the number of Board committees, and the degree of involvement of the independent directors in the Board committees. The Board further believes its present leadership structure ensures that management is aligned with the Board to effectively implement the business strategy endorsed by the Board.

Role of the Board of Directors in Risk Oversight

The Board of Directors recognizes the importance of on-going identification and management of risk in order to maintain a sound financial and reputational condition. The Board has adopted a risk management policy to affirm its awareness of the need to establish a program ofan Enterprise Risk Management (ERM). program. The Board commits to providing sufficient resources to ensure full implementation of an ERM program and will maintain an ERM framework to coordinate the many

5

aspects of risk.

The Board of Directors is ultimately responsible for the Bank’sCorporation’s risk management program and has approved a General Risk Appetite Statement. The Board of Directors and management use a balanced approach in determining acceptable levels of risk to undertake. The Corporation will only tolerate those risks which permit it to:manages risk by:

| · |

| · |

| · |

| · |

| · | Maintaining strong policies and procedures |

| · | Holding acceptable levels of capital to protect against losses |

Risk is an inherent component of the Corporation’s activities. The ability to effectively identify, assess, measure, respond, monitor, control, and report on risk activities is critical to the achievement of the Corporation’s mission and strategic objectives. The Corporation’s risk management approach reflects its values, influences its culture, and guides its operations. It is captured in policy statements, Board and management directives, operating procedures, training programs, and is demonstrated in daily activities by management and staff.

ERM is a group of structured and consistent risk management processes that are applied across the Corporation. An ERM program identifies, assesses, prioritizes, and provides a formal structure for the internal and external risks that impact an organization. These activities are categorized under commonly accepted categories of risk. The Corporation has elected to adopt the categories currently identified by the Office of the Comptroller of the Currency.

The Corporation’s ERM program is driven by an approach that is aligned with the Corporation’s profile and strategic objectives. It is enhanced by formalizing roles within the Corporation, active committees, policies and procedures, reporting, communication, and technology.

The Corporation’s ERM program produces various risk mitigation activities within the business units. The resulting strategic, financial, and operational risk mitigation activities that are implemented strengthen the Corporation, reduce the potential for unexpected losses, and manage the volatility experienced by the Corporation.

The corporate governance principles of the Corporation provide that a majority of the members of the Board of Directors, and each member of the Audit, Building and Expansion, Compensation, Nominating and Governance, and Trust Operations Committees, must meet the standards for independence as defined by the Securities and Exchange Commission (SEC) and Nasdaq.

Currently, the Corporation’s Board of Directors has nineten (10) members. Nine (9) members. Seven (7) directors: Joshua E. Hoffman, Willis R. Lefever, Donald Z. Musser,Jay S. Martin, Susan Y. Nicholas, Brian K. Reed, J. Daniel Stoltzfus, Mark C. Wagner, Judith A. Weaver, and Paul M.Roger L. Zimmerman Jr., meet the standards for independence. This constitutes more than a majority of the Board of Directors. Two (2) directors, Aaron L. Groff, Jr. and Paul W. Wenger, doJeffrey S. Stauffer does not meet the standards of independence becauseindependence. Mr. GroffStauffer is currently an employee of the Corporation, and Mr. Wenger was an employeeserves as the Chairman of the Corporation until his

4

retirement on December 31, 2015.Directors. Only independent directors serve on the Corporation’s Audit Committee, Compensation Committee, Nominating and Governance Committee, and Trust Operations Committee.Committees.

In determining each director’s independence, the Board considered loan transactions between the Bank and the individuals, their family members, and businesses with whom they are associated, as well as any contributions made to non-profit organizations with which they are associated. In each case, the Board determined that none of the transactions impaired the independence of the non-employee directors.

Meetings and Committees of the Board of Directors

During 2015,2023, the Board of Directors of the Corporation held sixteen (16) meetings, and all the committees of the Board of Directors held a combined total of seventeen (17)twenty-one (21) meetings, for a total of thirty-three (33)thirty-seven (37) meetings. Each of the directors attended at least 75% of the aggregate number of meetings of the Board of Directors and of the

6

meetings for committees on which they servedduring 2015.served during 2023. While the Corporation has no written policy requiring directors to attend the Annual Meeting of Shareholders, all membersthey are encouraged to do so and eight of the Board of Directors atten directors attended the time, except for Susan Y. Nicholas, were present at the 20152023 Annual Meeting of Shareholders.

The Board of Directors currently has the following committees:

| · | Audit Committee |

| · | Building and Expansion Committee |

| · | Compensation Committee |

| · | Nominating and Governance Committee |

| · | Trust Operations Committee |

Audit Committee. The members of the Audit Committee in 20152023 were: Joshua E. Hoffman (Chair), Jay S. Martin, Mark C. Wagner, (Chair), Donald Z. Musser, and Susan Y. Nicholas.Roger L. Zimmerman. All members of the Audit Committee have been determined to be independent of management of the Corporation as outlined by the SEC and Nasdaq rules for Audit Committees. The Audit Committee oversees the accounting and tax functions of the Corporation, recommends to the Board the engagement of independent auditors for the year, reviews with management and the auditors the plan and scope of the audit engagement, reviews the annual financial statements and any recommended changes or modifications to control procedures and accounting practices and policies, and monitors with management and the auditors the system of internal controls and accounting and reporting practices. The Board of Directors has not designated Joshua E. Hoffman as an Audit CommitteeFinancial Expert, as defined in the Sarbanes-Oxley Act and applicable SEC rules and regulations. The Board has not taken such action because it believes that each member of the Audit Committee has sufficient knowledge, in terms of financial experience and background, to perform his or her duties as a member of that Committee, and because it believes that an Audit CommitteeFinancial Expert is not necessary considering the relative non-complexity of the business structure of the Bank and the Corporation and its financial statements. The Audit Committee has the authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Audit Committee held five (5) meetings during 2015.2023.

The Audit Committee operates under a written charter which is available to shareholders on the Corporation’s website at www.enbfc.com/committee_charters.asphttps://enbfinancial.q4ir.com/corporate-overview/committee-charting/ or by contacting Barry W. Harting,Adrienne L. Miller, Esq., Corporate Secretary.

Building and Expansion Committee.The members of the Building and Expansion Committee in 20152023 were: Willis R. Lefever (Chair), Donald Z. Musser, and Brian K. Reed.Reed, J. Daniel Stoltzfus, and Judith A. Weaver. This committee provides guidance regarding the purchase and/or lease of real estate, the construction and/or renovation of branch offices, and general improvements to facilities. The Building and Expansion Committee met one (1) timeheld five (5) meetings during 2015.2023.

The Building and Expansion Committee operates under a written charter which is available to shareholders on the Corporation’s website at www.enbfc.com/committee_charters.asphttps://enbfinancial.q4ir.com/corporate-overview/committee-charting/ or by contacting Barry W. Harting,Adrienne L. Miller, Esq., Corporate Secretary.

Compensation Committee.The members of the Compensation Committee in 20152023 were: Paul M.Roger L. Zimmerman Jr. (Chair), Jay S. Martin and Mark C. Wagner, and Judith A. Weaver.Wagner. All members of the Compensation Committee have been determined to meet the standards and to be independent of management of the Corporation as outlined by

5

the SEC and Nasdaq. The Compensation Committee evaluates the Chief Executive Officer’s performance and makes recommendations to the Board of Directors concerning the Chief Executive Officer’s compensation based on its evaluation. The Chief Executive Officer is not present when these discussions occur. The Compensation Committee also makes recommendations to the Board of Directors concerning the salaries and benefits of directors, officers, and employees of the Corporation. Executive officers are not present when this occurs. The Compensation Committee did not hirereviewed compensation data that was prepared by a compensation consultant in 2015.2023. The Compensation Committee met four (4) times during 2015.2023.

The Compensation Committee operates under a written charter which is available to shareholders on the Corporation’s website at www.enbfc.com/committee_charters.asphttps://enbfinancial.q4ir.com/corporate-overview/committee-charting/ or by contacting Barry W. Harting,Adrienne L. Miller, Esq., Corporate Secretary.

Nominating and Governance Committee. The members of the Nominating and Governance Committee in 20152023 were: Susan Y. NicholasJoshua E. Hoffman (Chair), Willis R. Lefever, and Paul M. Zimmerman, Jr.Susan Y. Nicholas. The Nominating and Governance Committee consists entirely of directors that are independent of management of the Corporation as outlined by the SEC and Nasdaq. The Nominating and Governance Committee was established to provide continuing assistance to the Board of Directors in matters relating to corporate governance, Board performance, composition of the Board, and Board and Management succession planning. The Nominating and Governance Committee met three (3) times during 2015.2023.

The Nominating and Governance Committee operates under a written charter andCorporate Governance Guidelineswhich are available to shareholders on the Corporation’s website at www.enbfc.com/committee_charters.asphttps://enbfinancial.q4ir.com/corporate-overview/committee-charting/ or by contacting Barry W. Harting,Adrienne L. Miller, Esq., Corporate Secretary.

Trust Operations Committee.The members of the Trust Operations Committee in 20152023 were: Judith A. Weaver (Chair), Willis R. Lefever,Susan Y. Nicholas and Brian K. Reed. This committee consists entirely of directors who are independent of management of the Corporation as outlined by the SEC and Nasdaq. The Trust Operations Committee provides general supervision over all trust accounts held and managed in the Corporation’s Money Management GroupWealth Solutions, a Division of Ephrata National Bank and reviews all new and closed trust accounts. This committee met four (4) times during 2015.2023.

The Trust Operations Committee operates under a written charter which is available to shareholders on the Corporation’s website at www.enbfc.com/committee_charters.asphttps://enbfinancial.q4ir.com/corporate-overview/committee-charting/ or by contacting Barry W. Harting,Adrienne L. Miller, Esq., Corporate Secretary.

The Board of Directors does not have a formal process for shareholders to send communications to the Board. Due to the infrequency of shareholder communications to the Board of Directors, the Board does not consider a formal process necessary. Shareholders who wish to communicate to the Board of Directors should send their requests to Barry W. Harting,Adrienne L. Miller, Esq., Corporate Secretary, ENB Financial Corp, 31 East Main Street, P.O. Box 457, Ephrata, Pennsylvania 17522. Written communications received by the Corporation from shareholders are shared with the full Board of Directors no later than the next regularly scheduled Board meeting.

If a shareholder wants to submit a proposal to be considered for inclusion in the proxy statement for next year’s annual meeting, the written proposal must be received by the Corporation no later than December 7, 2016.10, 2024. Proposals received after that date may be considered at the annual meeting but, at the discretion of the Board of Directors, they may not be included in the proxy statement. Shareholder Proposals may be sent to Barry W. Harting,Adrienne L. Miller, Esq., Corporate Secretary, ENB Financial Corp, 31 East Main Street, P. O. Box 457, Ephrata, Pennsylvania 17522.

Transactions with Related Persons

Some of the directors, and executive officers of ENB Financial Corp or its wholly-owned subsidiary, Ephrata National Bank, were customers of, and had banking transactions with, Ephrata National Bank during 2015.2023. These transactions included deposit accounts, trust relationships, and loans. All loans and loan commitments made to such persons and to the companies with which they are associated were made in the ordinary course of business,

6

on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to the lender, and did not involve more than a normal risk of collectability or present other unfavorable features. It is anticipated that similar transactions will be entered into in the future. By using Ephrata National Bank’s products and services, directors, and executive officers have the opportunity to become familiar with the wide array of products and services offered by Ephrata National Bank to its customers.

Total loans outstanding as of December 31, 2015,2023, from Ephrata National Bank to the directors and executive officers as a group and members of their immediate families and companies in which they had an ownership interest of 10% or more was $4,248,000,$1,967,719 or approximately 4.5%1.64% of the Corporation’s total equity capital. The aggregate amount of indebtedness outstanding to the group described above as of the record date of this proxy, March 11, 2016,2024, was $4,051,000.$1,690,887. Prior to any business dealings with directors or executive officers, the Board of Directors reviews and discusses any such transaction outside the presence of the director, nominee director or executive officer.

The Board has adopted a hedging policy with respect to transactions by the Corporation’s directors and executive officers that hedge or offset, or are designed to hedge or offset, any decrease in the market value of ENB Financial Corp securities or limit their ability to profit from an increase in the market value of ENB Financial Corp securities.

Under the Corporation’s bylaws, nominations for election to the Board of Directors may be made by the Board of Directors or by any shareholder entitled to vote for the election of directors. Other than the Corporation’s bylaws, the Board does not have a policy regarding nominations for election to the Board of Directors because of the infrequency of such nominations. To make a nomination, a shareholder must mail a notice to Mr. Barry W. Harting,Ms. Adrienne L. Miller, Esq., Corporate Secretary, ENB Financial Corp, 31 East Main Street, P.O. Box 457, Ephrata, Pennsylvania 17522. Such notice of nomination must be made not less than fourteen (14) days nor more than fifty (50) days prior to the date of any meeting of shareholders called for the election of directors. If less than twenty-one (21) days of notice of the meeting is given to shareholders, such notice of nomination shall be mailed or delivered to the Secretary of the Corporation not later than the close of business on the seventh (7th) day following the day on which the notice of the meeting was mailed. Any notice of nomination shall contain the following information to the extent known by the notifying shareholder:

| · | The name, address, and principal occupation of the proposed nominee; |

| · | The total number of shares that, to the knowledge of the notifying shareholder, will be voted for the proposed nominee; |

| · | The name and residence address of the notifying shareholder; and |

| · | The number of shares of |

ENB Financial Corp’sIn addition to satisfying the foregoing requirements under the Corporation’s bylaws, to comply with the universal proxy rules, shareholders who intend to solicit proxies in support of director nominees other than the Corporation’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934, as amended, no later than March 8, 2025. However, if the date of the 2025 Annual Meeting is changed by more than 30 calendar days from the anniversary date of the 2024 Annual Meeting, then notice must be provided by the later of 60 calendar days prior to the date of the 2025 Annual Meeting or the tenth (10th) calendar day following the day on which public announcement of the date of the 2025 Annual Meeting is first made.

The Corporation’s bylaws authorize the number of directors at any time to be not less than five (5) and not more than twenty-five (25). The bylaws also provide for three (3) classes of directors, with each class serving three-yearthree- year terms to expire in successive years. Three (3)Four (4) Class AB directors have been nominated for election at the 20162024 Annual Meeting and, if elected, will serve until the 20192027 annual meeting of shareholders. All nominees were unanimously approved by the Board of Directors which is currently comprised of nine (9)ten (10) members. The Corporation’s bylaws require that directors who reach the age of seventy (70) prior to the date of the annual meeting when such director’s term expires may not stand for reelection to the Board of Directors. In 2015, no current directors had reached the age of seventy (70) prohibiting them from being reelected.

The Board of Directors unanimously nominated incumbent directors AaronWillis R. Lefever, Jay S. Martin, Judith A. Weaver and Roger L. Groff, Jr., Brian K. Reed, and Paul M. Zimmerman, Jr. to serve as Class AB Directors, Messrs. Lefever, Martin and theyZimmerman and Mrs. Weaver have consented to serve another term as a director, if reelected. If, prior to the annual meeting, any nominee should become unable to serve on the Board for any reason, proxies received from shareholders will be voted in favor of a substitute nominee as the Board of Directors determines. Any vacancy on the Board of Directors for any reason after the annual meeting may be filled by appointment by a majority of the Board of Directors then in office, and each person so appointed shall be a director until the expiration of the term of the class of directors to which he or she was appointed.

Cumulative voting rights exist in connection withAaron L. Groff, Jr. and Mary E. Leaman, the persons named as proxy holders, will vote the proxies “FOR” the election of directors, which means that each shareholder hasof the right, in person or by proxy, to multiply the votes to which he or she is entitled by the number of directors to be elected in a class and to cast the whole number of his or her votes for one nominee or to distribute all or fewer of them among two or more nominees in that class. Janice S. Eaby and John H. Shuey the persons named as

7

proxy holders, will have the right to vote cumulatively and to distribute their votes among nominees as they consider advisable,below, unless a shareholder indicates onthat his or her proxy card,vote should be withheld

9

from any or other methodall of voting, how he or she desires the votes to be cumulated for voting purposes.them. The three (3)four (4) nominees for director receiving the highest number of votes cast by shareholders entitled to vote for the election of directors shall be elected. Unless otherwise instructed, proxies received from shareholders will be votedFOR the election of the nominees of the Board of Directors.

The three (3)four (4) nominees for Class AB Director to be elected at the 20162024 Annual Meeting are:

| · |

| · |

| · | Judith A. Weaver; and |

| · |

The Board of Directors unanimously recommends that shareholders vote “FOR” these nominees.

Information and Qualifications of Nominees for Director and Continuing Directors

The following paragraphs provide information as of the record date of this proxy, March 11, 2016,2024, about the three (3)four (4) nominees to the Board of Directors whose term of office will expire at the 20162024 Annual Meeting, and each of the six (6) continuing directors whose terms will expire in subsequent years. The information presented includes the age of each nominee and continuing director, all positions he or she holds, his or her principal occupation and business experience for the past five years, the names of other publicly-held companies for which he or she currently serves as a director, or has served as a director during the past five years, and information on the involvement with non-profit and community organizations that each nominee and continuing director has told us about. In addition to the information presented below regarding specific experience and attributes and skills that the Board feels qualifies each nominee and director to serve as a director, the Board also believes that all nominees and continuing directors have a reputation for integrity, honesty, and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to ENB Financial Corp, Ephrata National Bank, and the Board.

There are no family relationships among any of the directors or executive officers of ENB Financial Corp or its wholly owned subsidiary, Ephrata National Bank.

Information about the number of shares of common stock beneficially owned by each director appears in the “SHARE OWNERSHIP” section below under the heading “Beneficial Ownership by Nominees for Director, Continuing Directors and Named Executive Officers.”

Nominees for Election as Class AB Directors for a term expiring at the 20192027 Annual Meeting

Aaron L. Groff, Jr.Willis R. Lefever

Director since 19992004

Mr. Groff,Lefever, age 66, has served69, is Owner of Lefever Construction, a home builder and land development proprietorship, and owner of Lefever Auto Sales, LLC, both near Ephrata, Pennsylvania. Mr. Lefever serves as Chairman, President,chair on the Building and Chief Executive Officer of ENB Financial Corp since July 1, 2008, and as Chairman, President, and Chief Executive Officer of Ephrata National Bank since January 1, 1999. Mr. Groff has been an employee of Ephrata National Bank since 1967, and has served in various officer positions including Cashier from 1980 to 1998, and Vice President from 1984 to 1998.Expansion Committee. In addition to demonstrating strong business acumen in his experience at Ephrata National Bank and ENB Financial Corp, Mr. Groff served two terms on the Boardsuccessful management of Directors of the Federal Reserve Bank of Philadelphia. During his terms as director of that organization, Mr. Groff served as the Chairman of the Audit Committee and as a member of the Corporate Governance and Nominating Committee. His service to the Federal Reserve Bank of Philadelphia provided Mr. Groff with broad insights into the regional and national financial markets. Also, Mr. Groff served as a member of the Board of Directors of the Pennsylvania Bankers Association from 2009 to 2012, and is currently a board member of several local civic, health industry, non-profit and faith-based organizations. Wesmall businesses for more than 40 years, we believe Mr. Groff’s qualificationsLefever is qualified to be a director of Ephrata National Bank and ENB Financial Corp includebecause of his 49understanding of the land development and building industry in Lancaster County, and his thorough knowledge and understanding of the social and economic aspects of the communities that are served by the Corporation.

Jay S. Martin, CISSP

Director since 2019

Mr. Martin, age 59, is employed by Donegal Mutual Insurance Company where he serves as the Vice President-Information Security Officer. He is credentialed as a CISSP (Certified Information Systems Security Professional), and has over 30 years of experience in all aspectsvarious roles in information technology, and has a B.S. degree from DeVry in Electronic Engineering. In his current role, he facilitates the design and implementation of information security policy, tracks and reports on cybersecurity risks and activity, and monitors regulatory compliance to cybersecurity requirements. We believe Mr. Martin is qualified to serve as a director of Ephrata National Bank and ENB Financial Corp because of his thorough understanding and knowledge of information technology, cybersecurity and experience in the banking industry,insurance industry.

Judith A. Weaver

Director since 2012

Ms. Weaver, age 65, now retired, was the President and his involvementOwner of Martin’s Trailside Express, Inc., a truck stop and restaurant, and a partner in MSW Properties LP, a family real estate partnership until they were sold in April 2019. Ms. Weaver was also President and Owner of Martin Services Group, Inc., a corporate reseller of bulk petroleum products until her retirement in April 2019. All of these entities were located in East Earl, Pennsylvania. In addition to her 45 years of business experience in the wholesale and retail industries, Ms. Weaver is also involved in her community, currently serving on the board of CrossNet Ministries, the Fellowship of Christian Athletes Regional Board, and as a Partner of LCBC Church. She previously served as a board member and Board Secretary at Garden Spot Village, a retirement community in New Holland, Pennsylvania, on the Regional Board of Hope International, and on the Board and Executive Committee at the New Holland Recreation Center in New Holland, Pennsylvania. Ms. Weaver serves as chair on the Trust Operations Committee. We believe Ms. Weaver is qualified to serve as a director of Ephrata National Bank and ENB Financial Corp because she is able to contribute her experience and thorough understanding of wholesale, retail, and service-oriented business issues affecting the communities in which the Corporation provides financial services.

8 Roger L. Zimmerman

Mr. Zimmerman, age 44, was appointed to the Board of ContentsDirectors in March of 2021. He is the Executive Vice President and an owner of Paul B. Zimmerman, Inc., a hardware, wholesale, manufacturing and industrial finishing company. Mr. Zimmerman has been associated with the company for 29 years and is a lifelong resident of Lancaster County having graduated from Warwick High School. Mr. Zimmerman has served/serves as a Deacon for the Indiantown Mennonite Church and a Board Member of Wellspan Health, Eastern Region. We believe Mr. Zimmerman is qualified to serve as a director of Ephrata National Bank and ENB Financial Corp because he is able to contribute his business experience and financial expertise both of which demonstrate his ability to maintain a business’ legacy while adapting to changing customer needs in an increasingly complex marketplace.

Continuing as Class A Directors for a term expiring at the 2025 Annual Meeting

Brian K. Reed, DVM, MBA

Director since 2013

Dr. Reed, age 53,61, is business owner and manager of Agricultural Veterinary Associates, LLC located in Lititz, Pennsylvania. His firm serves the agricultural community throughout Lancaster and Lebanon Counties and beyond. Dr. Reed has been a veterinarian for more than 2735 years, and focuses his practice on the dairy industry, combining veterinary medicine with business management consulting services. Dr. Reed is actively involved in a number of veterinary and agricultural organizations, dairy associations and commissions, and community endeavors. We believe Dr. Reed is qualified to serve as a director of Ephrata National Bank and ENB Financial Corp because of his business experience, his strong background in finance and administration, and his education and expertise in business management consulting and strategic planning with farmers in the dairy industry within the Corporation’s market area.

Paul M. Zimmerman, Jr.Jeffrey S. Stauffer

Director since 19992019

Mr. Zimmerman,Stauffer, age 64, is an owner62, was elected as President and pastChief Executive Officer of ENB Financial Corp and Ephrata National Bank as of January 1, 2020. In June 2020, Mr. Stauffer was appointed Chairman of ENB Financial Corp and Ephrata National Bank. Prior to that, he had been Senior Vice President, Senior Lender of Paul B. Zimmerman, Inc., headquartered in Ephrata Pennsylvania. Paul B. Zimmerman, Inc. isNational Bank since March 2017; Vice President, Senior Loan Officer from August 2014 to February 2017; Vice President, Commercial Lending Manager from 2012 to July 2014; Vice President, Commercial Loan Officer from 2002 to 2012; and employee of Ephrata National Bank since 1982. Mr. Stauffer serves on the parent companyFederal Reserve Board of Paul B, LLC, retail hardware stores; PBZ, LLC, a manufacturing business;Philadelphia Nominating Advisory Committee and Keystone Koating, LLC, a powder coating business. The Paul B. Zimmerman, Inc. family of companies serves on the agricultural, commercial, and consumer markets in Lancaster County and Mifflin County, Pennsylvania. In addition to his 40 years of business experience,PA Bankers Government Relations Policy Committee. Mr. Zimmerman is actively involved in the community, servingStauffer currently serves as a board member of several non-profitthe Board of Directors of the Ephrata Area Education Foundation, as a member of the Board of Directors of the Ephrata Community Health Foundation, as a member of the Ephrata Area School District Comprehensive Planning Steering Committee and faith-based organizations.as the Treasurer of the Guy K. Bard Student Loan Fund. Mr. Stauffer is also a member of the Denver Ephrata Area Rotary Club having previously served as past President. We believe that Mr. Zimmerman’s strong business experience in purchasing, sales, strategic planning, and finance and his broad understanding of the business and social community he serves qualify him asStauffer’s qualifications to be a director of Ephrata National Bank and ENB Financial Corp.Corp include his more than 40 years of experience with the bank and in the banking industry generally.

Continuing as Class B Directors for a term expiring at the 2018 Annual Meeting

Willis R. LefeverJ. Daniel Stoltzfus

Director since 20042022

Mr. Lefever,Stoltzfus, age 61,54, owns and manages both Stoltzfus Mfg., LLC, formed in 1998 and located in Honey Brook, Pennsylvania and Stoltzfus Manufacturing, Inc. located in Path Valley, Pennsylvania, which has operated for over twenty-five (25) years producing quality equipment such as hay and feeder wagons and bale carriers for the agricultural industry. Mr. Stoltzfus’s manufacturing company also provides custom work ranging from fabrication, welding, and repairs to CNC plasma cutting services for the local agricultural community. Additionally, Mr. Stoltzfus is Owner of Lefever Construction, a home builder and land development proprietorship, andmajority owner of Lefever Auto Sales,Westbrooke IP, LLC, both near Ephrata, Pennsylvania.which is a commercial real estate holding entity in Honey Brook, PA, and he is sole owner of Path Valley Industries, LLC, a real estate holding entity for lease to Stoltzfus Manufacturing, Inc. In addition to demonstrating strong business acumen in his successful management of small businesses for more than 37 years,these manufacturing companies and real estate holding entities, we believe Mr. LefeverStoltzfus is qualified to be a director of Ephrata National Bank and ENB Financial Corp because of his understanding of the land development and building industry in Lancaster County, and his thorough knowledge and understanding of the social and economic aspects of the communities that are served by the Corporation.

Donald Z. MusserContinuing as Class C Directors for a term expiring at the 2026 Annual Meeting

Joshua E. Hoffman, MBA, CPA, CMA, CPCU, NACD.DC

Director since 20072017

Mr. Musser,Hoffman, age 55,41, is Ownerthe owner and managing member of Little Stream Auto RentalsHeiter Fitness LLC, a fitness franchise development and operating entity located in New Holland,Lititz, Pennsylvania. In addition to his 31 yearsMr. Hoffman has recently held accounting and executive leadership roles at Garman Builders, Inc. and Alvernia University. From 2018 through 2020, Mr. Hoffman served as a leadership and business consultant. From 2014 through 2018, Mr. Hoffman served as the CEO and CFO of experienceReamstown Mutual Insurance Company located in business,Reamstown, PA. Mr. MusserHoffman also previously held accounting and leadership roles at Donegal Mutual Insurance Company. Mr. Hoffman is very active in non-profita CPA, CMA, CPCU, and faith-based service organizations in Northern Lancaster County, currently servingholds an MBA from Pennsylvania State University. Mr. Hoffman is also an NACD Certified Director. Mr. Hoffman serves as Board Chair of Lighthouse Vocational Services,chair on the Nominating and Board Secretary of Community Aid Relief Effort.Governance Committee and the Audit Committee and is considered a financial expert. We believe Mr. Musser is qualifiedHoffman’s experience in the insurance industry along with his accounting background and experience qualifies him to serve as a director of Ephrata National Bank and ENB Financial Corp because of his business experience and his particular knowledge and understanding of the needs of the geographical, social, and faith communities of which he is a part.

Judith A. Weaver

Director since 2012

Ms.Weaver, age 57, is the Owner and President of Martin’s Trailside Express, Inc., a truck stop and restaurant, and Martin Services Group, Inc., a corporate reseller of bulk petroleum products. Ms.Corp.

9

Weaver is also a partner in MSW Properties LP, a family real estate partnership. All of these entities are located in East Earl, Pennsylvania. In addition to her 40 years of business experience in the wholesale and retail industries, Ms. Weaver is also involved in her community, currently serving as a director of the Pennsylvania Regional Board of Hope International, and previously having served as a board member and Board Secretary at Garden Spot Village, a retirement community in New Holland, Pennsylvania, and on the Executive Committee at the New Holland Recreation Center in New Holland, Pennsylvania. We believe Ms. Weaver is qualified to serve as a director of Ephrata National Bank and ENB Financial Corp because she is able to contribute her experience and thorough understanding of wholesale, retail, and service-oriented business issues affecting the communities in which the Corporation provides financial services.

Continuing as Class C Directors for a term expiring at the 2017 Annual Meeting

Susan Y. Nicholas, Esquire

Director since 2008

Ms. Nicholas, age 56,64, is an attorney and Partnermanaging partner in the law firm, Young and Young Attorneys at Law, in Manheim, Pennsylvania. Ms. Nicholas has 3038 years of experience as an attorney, with specific legal practice in the areas of estates, trusts, and real estate. Along with her legal experience, Ms. Nicholas brings to the Board an interest and knowledge of corporate governance issues and a familiarity with the social and economic composition of the greater Manheim community. In addition to the expertise in the fields of business and family law, Ms. Nicholas devotes time to her community by serving on the boardsis a member of the Manheim Central Student Loan Fund Association, Strasburg Railroad,Pennsylvania and Sudan Rebirth Ministry.Lancaster Bar Associations and First Presbyterian Church in Lancaster. She spends most of her free time supporting a mission project in Nicaragua. We believe Ms. Nicholas’ particular skills and her involvement inwith the community affairs qualify her to serve as a director of Ephrata National Bank and ENB Financial Corp.

Mark C. Wagner

Director since 2007

Mr. Wagner, age 62,70, is Co-ownera retired Owner and President of White Oak Mills, Inc., located in Elizabethtown, Pennsylvania. White Oak Mills, Inc. manufactures livestock and poultry feeds and serves the agricultural communities throughout Southeastern Pennsylvania. Additionally, Mr. Wagner owns and operates several farms in Lancaster County, Pennsylvania involved in livestock production. Mr. Wagner has served on the Economic Advisory Council of the Federal Reserve Bank of Philadelphia and as a director on numerous agriculture industry boards across Pennsylvania. In addition, Mr. Wagner currently serveshas served as a board member of Pleasant View Retirement Community in Manheim, Pennsylvania.Pennsylvania and served on the governing body of the local municipality. Mr. Wagner serves on the Compensation Committee and the Audit Committee. We believe Mr. Wagner is qualified to serve as a director of Ephrata National Bank and ENB Financial Corp because of his 37over 48 years of business experience, his strong background in management, finance and administration, his familiarity and close involvement with the agriculture industry in Lancaster County, Pennsylvania, and his community involvement.

Paul W. Wenger

Director since 2008

Mr. Wenger, age 66, was an employee of Ephrata National Bank from 1967 until his retirement on December 31, 2015. He served as Vice President and Corporate Secretary of ENB Financial Corp from January 1, 2009 to December 31, 2015, Treasurer of ENB Financial Corp from July 1, 2008 to December 31, 2008, and Senior Vice President and Cashier of Ephrata National Bank from 1999 to December 31, 2015. During his employment with the Corporation, Mr. Wenger also held various other officer positions including Vice President of Deposit Accounting, and Vice President of Operations. Also, Mr. Wenger is active in Northern Lancaster County municipal government and serves as a board member of several civic, non-profit, and faith-based organizations. We believe he is qualified to serve as a director of Ephrata National Bank and ENB Financial Corp because of his 49 years of experience in bank management, his strong background in bank automation, operational and procedural matters, corporate governance, and his expertise in shareholder relations and other corporate issues.

10

Beneficial Ownership by Principal Holders

The following table shows, to the best of our knowledge, the names and addresses of each person or entity who owned shares of record, or who is known by the Board of Directors to be the beneficial owner of more than 5% of ENB Financial Corp’s outstanding common stock as of the record date of this proxy, March 11, 2016.2024.

| Name and Address | Shares Beneficially Owned | Percentage of Outstanding Common Stock Beneficially Owned |

J. Harry Hibshman Scholarship Fund Trust C/O 31 East Main Street Ephrata, Pennsylvania 17522 | 1,785,600 | 31.58% |

Robert C. Wenger Charitable Trust C/O 31 East Main Street Ephrata, Pennsylvania 17522 | 500,406 | 8.85% |

| (1) |

| (2) | The Ephrata National Bank serves as the trustee of the Robert C. Wenger Charitable Trust. |

Beneficial Ownership by Nominees for Director, Continuing Directors and Named Executive Officers

The following table shows, as of March 11, 2016,2024, the record date of this proxy, the number of shares and percentage of ENB Financial Corp’s outstanding common stock beneficially owned by each nominee for director, each continuing director, each named executive officer, and all nominees, continuing directors, and named executive officers as a group.

Beneficial ownership of shares of ENB Financial Corp common stock is determined in accordance with the definitions of beneficial ownership in the General Rules and Regulations of the Securities and Exchange Commission and may include stock owned by or for the individual’s spouse and minor children and any other relative who has the same home, as well as stock that the individual has or shares voting or investment power, or has the right to acquire beneficial ownership within sixty (60) days after March 11, 2016.2024. In the following table, the number of shares owned by the indicated persons is rounded to the nearest whole share.

| Name of Individual | Shares Owned and Nature of | Percentage |

| or Identity of Group | Beneficial Ownership | of Class |

| Directors and Nominees | ||

| Joshua E. Hoffman | 8,214(1) | * |

| Willis R. Lefever | 12,382(2) | * |

| Jay S. Martin | 3,628(3) | * |

| Susan Y. Nicholas | 15,921(4) | * |

| Brian K. Reed | 9,341(5) | * |

| Jeffrey S. Stauffer | 15,419(6) | * |

| J. Daniel Stoltzfus | 2,694(7) | * |

| Mark C. Wagner | 14,586(8) | * |

| Judith A. Weaver | 8,170(9) | * |

| Roger L. Zimmerman | 2,610(10) | * |

| Named Executive Officers | ||

| Jeffrey S. Stauffer (included in list of directors above) | ||

| William J. Kitsch, IV | 5,581 | * |

| Chad E. Neiss | 18,033 | * |

| All Nominees for Director, Continuing Directors, and | ||

| Executive Officers as a Group (17 persons) (11) | 138,939 | 2.46 |

| Name of Individual | Shares Owned and Nature of | Percentage | ||||

| or Identity of Group | Beneficial Ownership | of Class | ||||

| Directors and Nominees | ||||||

| Aaron L. Groff, Jr. | 7,354 | (1) | * | |||

| Willis R. Lefever | 6,040 | (2) | * | |||

| Donald Z. Musser | 3,322 | (3) | * | |||

| Susan Y. Nicholas | 5,701 | (4) | * | |||

| Brian K. Reed | 1,427 | (5) | * | |||

| Mark C. Wagner | 4,923 | (6) | * | |||

| Judith A. Weaver | 2,370 | (7) | * | |||

| Paul W. Wenger | 7,835 | (8) | * | |||

| Paul M. Zimmerman, Jr. | 6,469 | (9) | * | |||

| Named Executive Officers | ||||||

| Aaron L. Groff, Jr. (included in list of directors above) | ||||||

| Scott E. Lied | 5,322 | (10) | * | |||

| Barry E. Miller | 161 | (11) | * | |||

| Paul W. Wenger (included in list of directors above) | ||||||

| All Nominees for Director, Continuing Directors, and | ||||||

| Named Officers as a Group (13 persons) (12) | 55,936 | 1.96% | ||||

____________________________

11

* Indicates beneficial ownership of less than 1% of outstanding shares.

| (1) | Mr. |

| (2) | Mr. Lefever holds |

| (3) | Mr. |

| (4) | Ms. Nicholas holds these shares individually. |

| (5) | Dr. Reed holds |

| (6) | Mr. Stauffer and his spouse hold 11,524 of these shares jointly and he holds 2,178 individually and 1,717 Restricted Stock Units are held individually by Mr. Stauffer which vest over three years pursuant to the Executive Officer Employment Agreement described herein. |

| (7) | Mr. Stoltzfus holds these shares jointly with his spouse. |

| (8) | Mr. Wagner holds these shares individually. |

| Ms. Weaver holds |

| (10) | Mr. |

| (11) |

| Includes 22,360 shares beneficially held by |

Delinquent Section 16(a) Beneficial Ownership Reporting Compliance16 Reports

Section 16(a) of theSecurities Exchange Act of 1934, as amended, requires directors, executive officers, and persons or entities who beneficially own more than 10% of the Corporation’s outstanding stock to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission. Based solely upon review of Securities and Exchange Commission Forms 3, 4, and 5 and amendments thereto, the Corporation believes that during the fiscal year ended December 31, 2015,2023, its directors, executive officers and greater than 10% beneficial owners timely filed all reports required under Section 16(a) of theSecurities Exchange Act of 1934, as amended.

BOARD COMPENSATION AND PLAN INFORMATION

Compensation of the Board of Directors

The following table summarizes the compensation paid by the Corporation during 20152023 to Independent Directors.

Directors as defined by the SEC, Nasdaq standards, and all applicable laws. Compensation received by directors who are also employees of the Corporation is reported on the OTHER COMPENSATION TABLE in the Executive Compensation Section of this document.do not receive additional compensation for board service. In 2015, allJuly 2023, directors received a semi-annualpaid in advance retainer of $4,500 and $800$20,000 which covers the period of July 1, 2023 through June 30, 2024. The directors also received $950 for each Board meeting they attended.attended through and including June 2023. The directors received $1,000 for each Board meeting attended from July through December 2023. Board meetings were held one (1) timeonce each month during 2015,2023, with the exception of April, July, September,March, May, August and December,November, when two (2) Board meetings were held. Independent Directors also received $350$400 for attendance at separate committee meetings. Directors each received $1,000 for attendance at the Strategic Planning Meeting held in October 2023. Directors serving as Chairs of committees did not receive additional compensation for their role as Chair of a committee. The members of the Board of Directors of ENB Financial Corp also serve as members of the Board of Directors of Ephrata National Bank. Board meetings for ENB Financial Corp and Ephrata National Bank were held concurrently during 20152023 and directors did not receive additional compensation for attending both meetings.

12

| Fees Earned | All Other | ||

| Name | or Paid in Cash | Compensation | Total |

| ($) | ($) | ($) | |

| Willis R. Lefever | 24,600 | 0 | 24,600 |

| Donald Z. Musser | 22,050 | 0 | 22,050 |

| Susan Y. Nicholas | 24,250 | 0 | 24,250 |

| Brian K. Reed | 22,400 | 0 | 22,400 |

| Mark C. Wagner | 24,150 | 0 | 24,150 |

| Judith A. Weaver | 24,600 | 0 | 24,600 |

| Paul M. Zimmerman, Jr. | 22,650 | 0 | 22,650 |

| Name | Fees Earned or Paid in Cash | All Other Compensation |

Total | |||||||||

| ($) | ($) | ($) | ||||||||||

| Joshua E. Hoffman | 40,800 | 0 | 40,800 | |||||||||

| Willis R. Lefever | 40,800 | 0 | 40,800 | |||||||||

| Jay S. Martin | 41,200 | (1) | 0 | 41,200 | ||||||||

| Susan Y. Nicholas | 39,000 | 0 | 39,000 | |||||||||

| Brian K. Reed | 38,850 | (2) | 0 | 38,850 | ||||||||

| J. Daniel Stoltzfus | 36,850 | 0 | 36,850 | |||||||||

| Mark C. Wagner | 40,200 | (3) | 0 | 40,200 | ||||||||

| Judith A. Weaver | 41,200 | (4) | 0 | 41,200 | ||||||||

| Roger L. Zimmerman | 40,250 | 0 | 40,250 | |||||||||

| (1) | Mr. Martin invested a percentage of his initial annual retainer compensation and a percentage of his quarterly compensation in the purchase of ENB Financial Corp shares. |

| (2) | Mr. Reed invested a percentage of his initial annual retainer compensation and a percentage of his quarterly compensation in the purchase of ENB Financial Corp shares. |

| (3) | Mr. Wagner invested his initial annual retainer compensation in the purchase of ENB Financial Corp shares. |

| (4) | Mrs. Weaver invested a percentage of her initial annual retainer compensation in the purchase of ENB Financial Corp shares. |

Non-Employee Directors’ Stock Plan

The Board of Directors believes that increasing the Board’s financial interest in the Corporation will create a unity of purpose and identity and will be beneficial to the growth of the Corporation. To provide non-employee directors of the Corporation with a convenient and systematic method of acquiring shares of the Corporation’s stock, the Board of Directors established the 20102020 Non-Employee Directors’ Stock Plan effectiveunder which 100,000 shares of common stock were registered with the SEC on June 1, 2010.3, 2020. Under the Plan, non-employee directors may elect to use all, or some, of the compensation they receive as directors to purchase shares in the Corporation. All shares purchased through the 20102020 Non-Employee Directors’ Stock Plan are purchased at market price, without a discount.

The following table presents selected information about executive officers of ENB Financial Corp and Ephrata National Bank as of the proxy record date, March 11, 2016.2024. These officers are elected annually by the Board of Directors and hold office at the Board’s discretion.

| Name | Age | Principal Occupation for the Past Five Years and |

Position Held with ENB Financial Corp and Ephrata National Bank | ||

13

EXECUTIVE COMPENSATION SUMMARY STATEMENT

It is the intent of the Compensation Committee to provide our named executive officers with a compensation package that is market competitive, promotes the achievement of our strategic objectives and is aligned with operating and other performance metrics to support long-term shareholder value.

For purposes of this proxy statement, named executive officers are those executive officers who were, at December 31, 2015, (i) the Chief Executive Officer, (ii) the Chief Financial Officer, and (iii) the other two most highly compensated executive officers of the Corporation. The following officers of the Corporation were identified as named executive officers:

| William J. Kitsch, IV | 49 | Senior Executive Vice President, Chief Revenue Officer since October 2021. Senior Vice President, Business Performance Strategist & Head of Agricultural Lending since April 2021 and Vice President, Agricultural Lending Manager at Ephrata National Bank since November 2016. Mr. Kitsch holds an MBA and was formerly employed at a community bank as a Senior Vice President, Market Leader and as a Regional Lending Manager, Sales Manager and Loan Officer at MidAtlantic Farm Credit for over thirteen years. In the community, Mr. Kitsch serves as an Adjunct Professor, Project Executive at Fox School of Business, Temple University, Pennsylvania. Mr. Kitsch also serves on the Board of the Pennsylvania Association of Sustainable Agriculture. |

| Chad E. Neiss | 50 | Senior Executive Vice President, Chief Strategy Officer since October 2021. Mr. Neiss also holds the position of Executive Vice President, Head of Mortgage Division of Ephrata National Bank which was initiated when Mr. Neiss joined the Bank as VP, Residential Mortgage Lender in 2014. Mr. Neiss subsequently held the position of SVP and then EVP Residential and Consumer Lending. In the community, Mr. Neiss serves as a Board Member of both Bankers Settlement Services Capital Region and the Building Industry Association of Lancaster. |

| Joselyn D. Strohm | 41 | Senior Executive Vice President, Chief Operating Officer since June 2023. Previously employed by FIS, Jacksonville, Florida as the Senior Director of Product Management/Line of Business Leader from October 2015 until joining Ephrata National Bank. During her employ with FIS, Ms. Strohm managed a team of sixteen product managers and product owners and had responsibility for determining product direction and strategy for eight FIS products as well as determining capital needs and capital allocations for each. Previously, Ms. Strohm served as Product Support Specialist and then Manager at FIS for seven years and was responsible for the FIS Bankway Application, features programing and client communication areas. FIS Bankway Application is the core system at Ephrata National Bank. Ms. Strohm has received notable recognitions awarded by the FIS Transformational Leadership Program and Client Excellence Award. |

| 46 | Executive Vice President, Chief Financial Officer since August 2021. Treasurer of ENB Financial Corp since August 2021. Ms. Bitner previously held the position of Senior Vice President, Controller, Ephrata National Bank from June 2020 to August 2021 and | |

| Cindy L. Cake | 40 | Executive Vice President, Chief Human Resource Officer since August 2019. Ms. Cake holds an MBA and served in previous capacities as a Human Resource Executive for other major firms. Ms. Cake holds a PHR license. In the community, Ms. Cake currently serves as a Board Member of Good Samaritan Services. |

| Nicholas D. Klein | 39 | Executive Vice President and Chief |

| 62 | Senior Vice President, |

Business Performance HighlightsEXECUTIVE COMPENSATION

DespiteThe Compensation Committee establishes a Compensation Philosophy for the ongoing challenging economic environment we faced in 2015, our financial performance continuesCorporation, and makes recommendations to demonstrate a strong, well-capitalized, local community bank providing outstanding shareholder returnthe Board of Directors regarding the salaries and value.benefits of directors, officers, and employees of the Corporation and Bank.

Business performance highlights in 2015 include:

14

COMPENSATION DISCUSSION AND ANALYSIS

Executive Compensation Objectives

The Corporation’sCompensation Philosophyis to offer competitive compensation opportunities to all employees based upon individual contribution and personal performance. The Corporation designsExecutive Compensation Packagesto attract and retain key management employees and to motivate these employees to take actions that enhance shareholder value and attain the Corporation’s goals. TheExecutive Compensation Policiesare intended to ensure that each executive has a stake in enhancing and promoting Corporation products and services, improving profitability, and providing increased shareholder value through growth of the Corporation’s common stock and the payment of enhanced dividends. The Corporation provides both an annual incentive plan for all employees and employment agreements for certain executive officers.

Compensation Committee Membership

ENB Financial Corp’s Compensation Committee is comprised of the following three (3)Independent members of the Board of Directors who serve on the Committee for a one (1) year renewable term.

15

Compensation Committee Responsibilities and Process

The Compensation Program is administered by the entire Board of Directors as recommended by the Compensation Committee. The Compensation Committee is responsible for establishing the Corporation’sCompensation Philosophyand making compensation recommendations regarding the position of Chairman, President, and CEO. The Compensation Committee operates under a written charter, adopted by the Board of Directors, which is available on the Corporation’s website atwww.enbfc.com/committee_charters.asphttps://enbfinancial.q4ir.com/corporate- overview/committee-charting/ or by contacting Barry W. Harting, Corporate Secretary.Adrienne L. Miller, Esq., Secretary of the Corporation. The Charter outlines the Committee’s responsibilities including:

| · | EstablishingCompensation Policies; |

| · | DeterminingBase Salaries, annual incentive and |

| · | Annually approving (along with the entire Board of Directors) the Ephrata National Bank’sCompensation Policies; |

| · | Evaluating and determining the types of benefits appropriate to enhance theExecutive Compensation Program Objectives; |

| · | Retaining compensation consultants to assist in evaluation of compensation arrangements; and |

| · | Approving target financial performance levels. |

The Committee meets with the Vice President of Human Resources of the Corporation, who provides an analysis of the survey results (discussed below) and a workforce comparison. The Committee reviews survey projections of grade-range changes, average-wage increases, and specific job-related minimums, midpoints, and maximums paid by competing survey participants. The Committee also recommends methods of handling employee compensation that falls below or above the Corporation’s grade ranges.

TheCompensation Committee reviews guidelines for compensation, bonus, and other compensation perquisites for all Corporation employees. All employees, including executives, receive annual performance appraisals, reviewing goal attainment and overall job performance. The Chairman, President, and CEO, the Sr.Senior Executive VP, Chief Operating Officer, the Senior Executive VP, Chief Revenue Officer and the Sr.Executive VP, Chief Risk Officer conduct the performance appraisals of the Bank Management Team Members.

Effective January 1, 2022, the Corporation implemented an Annual Incentive Plan, (“AIP”) for all employees. The Role of the Shareholders’ Say on Pay Vote

At the 2013 Annual Meeting of Shareholders, the shareholders overwhelmingly voted in favor of approving theAIP provides eligible employees an opportunity to earn additional compensation of the Corporation’s Named Executive Officers as presented in the Compensation Discussion and Analysis presented in the Corporation’s proxy statement dated April 5, 2013. The Compensation Committee took the results of the vote into consideration in awarding compensation consistent with the policies and practices outlined in the Compensation Discussion and Analysis. The shareholders approved a proposal at the Corporation’s 2013 Annual Meeting of Shareholders to conduct an advisory voteeach year based on the Corporation’s executive compensationperformance and the personal performance of each employee in relation to pre- established performance metrics. Each employee receives a copy of their AIP which provides details for their financial award eligibility for both bank and personal goals (when applicable). In 2023 the Named Executive Officers every three (3) years. Shareholders are being askedCorporation accrued over four hundred ninety five thousand ($495,000) dollars and actually paid five hundred one thousand and forty two ($501,042) dollars in earned AIP payments to voteemployees in favor of approving the compensation of the Corporation’s Named Executive Officers at this year’s 2016 Annual Meeting.

Chairman, President, and CEO Performance ReviewMarch 2024.

The Compensation Committee annually conducts a performance review of the Chairman, President, and CEO’s job performance. As with all other positions within the organization, the Corporation uses a formal system of job evaluation for the Chairman, President, and CEO. The Compensation Committee provides a written CEO Performance Evaluation form to allindependent membersresults of the Board of Directors. Each member completes an Evaluation that coversGoal Attainment, Management Decisions, General Corporate Operations, andOverall Corporate Performance. Following receipt of the completed evaluations, an overall rating is calculated. The resultsreview and any recommendation for a compensation change are discussed with the remainingindependent members of the Board of Directors who make a decision regarding a compensation change. Many items play a role in determining the level of annual compensation for the Chairman, President, and CEO, including:

16

In determining whether theBase Salary of the Chairman, President, and CEO should be adjusted, the Board of Directors takes into account non-quantitative individual performance and quantitative performance factors of the Corporation, plus information regarding the range compensation paid to Executives performing similar duties for financial institutions in the Corporation's market area.

While the Compensation Committee does not use predetermined numerical formulas to determine changes in compensation for the Chairman, President, and CEO, it weighs a variety of different performance factors in its deliberations. The Compensation Committee has emphasized, and will continue to emphasize, the Corporation’s Profitability, Capital Position and Income Level,andReturn on Tangible Equity,as well as the individual’sLeadership and Managerial Qualities, Personal Qualities, Judgment, Knowledge and Skills, Board Relations, Bank Staff Relations, Community Relations, andPolitical Effectiveness, as factors in setting the compensation for the position of Chairman, President, and CEO. The Compensation Committee also considers the amount which has been previously paid to the Chairman, President, and CEO.

The Compensation Committee’s recommendations are presentedCommittee also recommends to the entire Board from time to time the amount, determination and payment of Directorsremuneration to be paid by the Corporation to directors in light of time commitment, fees paid by comparable companies and the proposals are approvedresponsibilities. The Compensation Committee may form and ratified or sent backdelegate authority to the committee for additional reviewindividuals and re-presentation at a later date. The Chairman, President,subcommittees when and CEO does not participate in, and is not present, for these discussions. Only independent (non-employee) Board members participate in this discussion.as it deems appropriate.

The Role of Executive Officers in Determining Compensation

The Compensation Committee meets with the Executive Vice President, ofChief Human ResourcesResource Officer of the Corporation who provides the Committee with the information necessary for their analysis of the appropriate compensation for the executive officers. Mr. GroffStauffer participated during Board decisions regarding the compensation of employees and other executive officers. He did not however, participate and was not present when his performance and compensation was discussed.

Elements of the Executive Compensation Program

The Corporation’sExecutive Compensation Package includesBase Salary,Bonuses,Insurance,Retirement Plans,Stock Purchase Plans, and in certain instances, aCompany-provided Car, andDirector Fees.

The Corporation is managed by a thirteen-member management team which includes the President and CEO and the named executive officers. The management team oversees the various functional units within the Corporation and reports to the President and CEO, the Sr. VP, Chief Operating Officer or SVP, Chief Risk Officer.